Optionality and the Barbell Strategy

Hi Friends,

In last week's discussion, we talked about arbitrage, which involves taking advantage of price differences between markets to make a profit with little to no risk. However, these opportunities can be short-lived and difficult to find. This is where the concept of "Optionality" comes in, which is a consistent theme among Nassim Taleb's best sellers.

Before diving into the actual “optionality” idea, I would like to explain a bit more about what I mean by “unpredictable” and “nonlinear” here.

1. The World is Unpredictable

The 2008 subprime mortgage crisis in the US is a prime example to explain the unpredictability of the world. In the era of globalization, events in one industry can have a ripple effect that impacts other industries and countries. The crisis quickly expanded to the banking industry, stock markets, and consumer spending, among others. The crisis also had a global impact, hitting countries in Asia such as Japan, South Korea, and China. Failure of judgment from US Investment Bankers was leading manufacturers in South East Asia to lose their jobs due to lowering demand.

Interestingly, even the smartest brains and visionary entrepreneurs, like Steve Jobs, can be completely wrong about their predictions for the future. When facing criticism during the early stages of the iPhone launch, Jobs made three classic explanations regarding the product: it didn't need a 3G network, apps, or a large screen. (We all know what would have happened if Jobs had followed his own words 😂 )

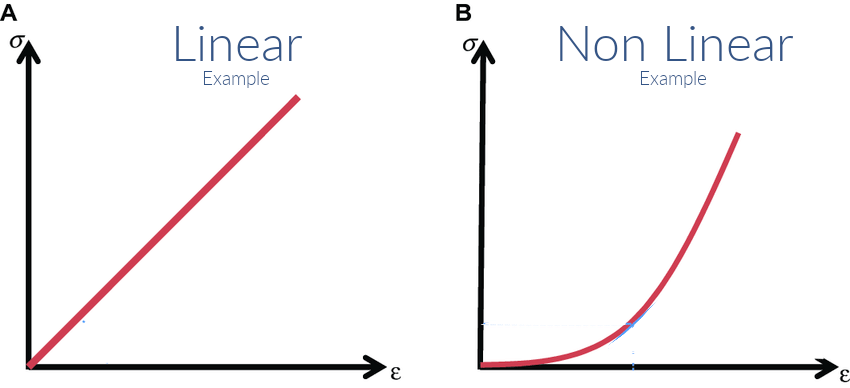

2. Impact of an event could be non-linear

Nonlinear is a term used to describe a situation where an input does not have a directly proportional output. Use the spread of COVID-19 to be an example, in the early stages of an outbreak, the number of infected people may grow slowly, but as more people become infected, the rate of spread can accelerate rapidly. This is due to the fact that each infected person can potentially infect multiple other people, creating a "snowball effect" that can quickly lead to an epidemic. These events are usually named “Black Swan” by Taleb.

Positive outcomes can also arise from "black swan" events. For example, having a celebrity or influential person like Bill Gates recommend your book can turn it into a bestseller. (At the same time, the nonlinearity of impact means that the power of having your book recommended by 100 friends may not be comparable to the impact of a single recommendation from Gates.)

3. So, how are they related to “optionality”?

In a world that constantly surprises us with unpredictable and nonlinear events, it's crucial to have a strategy that allows us to expose ourselves to good "black swan" events while minimizing potential losses. This is where the concept of "optionality" comes in. Optionality means having the freedom to take advantage of opportunities when they arise, without any obligation to do so. It's like having a secret weapon that allows you to seize the moment when it matters the most. By creating optionality, we can increase our chances of success and achieve our goals more effectively. The beauty of optionality lies in its asymmetry: the potential losses are limited and bearable, but the potential gains can be enormous and limitless.

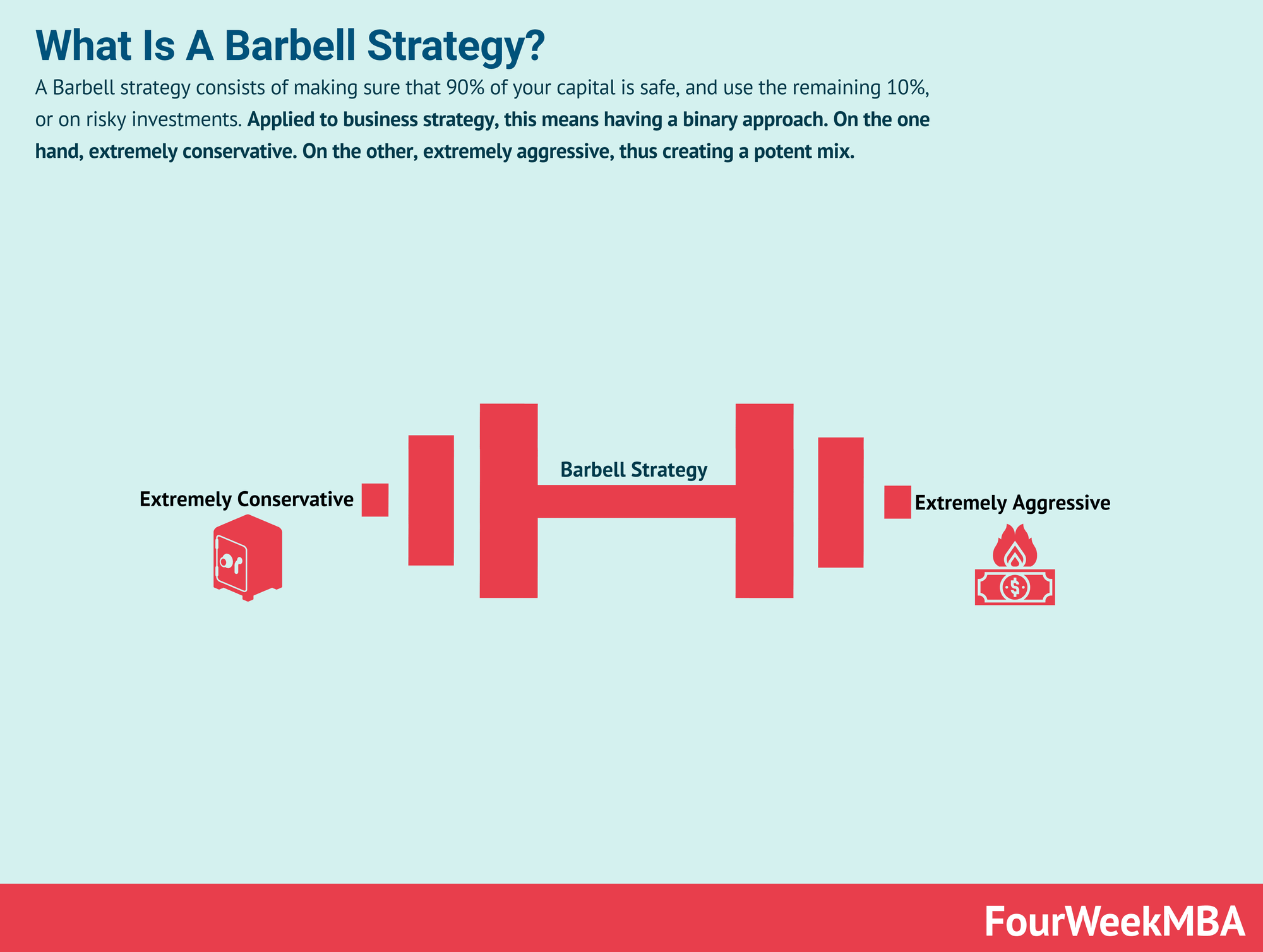

4. The Barbell Strategy

Nassim Taleb, in his book "Antifragile," describes his use of the barbell strategy in his own investment approach. A barbell strategy is a tool for achieving optionality and maximizing returns while minimizing risk. The barbell is divided into two categories, highly safe, low-risk investments, and highly speculative, high-risk investments. Taleb's low-risk investments are typically in the form of cash, gold, or other assets that are highly liquid and have a low probability of losing value. On the other end of the barbell are his high-risk investments, which typically involve buying options or other derivatives that have the potential for huge returns but also carry a high degree of risk.

Taleb believes that this approach allows him to protect himself against catastrophic losses while also positioning himself to take advantage of good "black swan" events. The asymmetry of the barbell strategy allows him to benefit from the positive "black swans" while limiting his downside risk. In his view, the barbell strategy is the best way to achieve optionality and create huge profits in an unpredictable and nonlinear world.

5. How can we make good use of the Barbell Strategy?

Alright, I can already tell the immediate questions that pops up in your mind: “Ok, the optionality idea sounds cool and this dude made shit of money out of it, but how is it related to ME as a normal individual?”

Using myself as an example in the consulting industry, core competencies of the role include storytelling, Excel modelling, and problem-solving. Additionally, I devote 10-20% of my time to other areas, such as taking exams related to product management and launching a weekly newsletter. I am still unsure if these effort might create disproportional returns to me sometime in the future. But who knows, let's embrace the unknown and take advantage of the positive "black swans" that come our way!

That's it for this week's weekly digest. Ciao!

Sherman

Things that I found interesting this week:

🥊 Sports — Muay Thai: I'm excited to share that I tried my first Muay Thai class with my friend Ivan and it was a blast! I'm definitely planning on going back for more. 🔥

🎥 Movie — Free Solo (featuring Alex Honnold): Although we have talked about maximizing returns from risk, I have great respect for those who take on huge risks to push the limits of human potential. I recently watched the documentary "Free Solo," which features Alex Honnold, a rock climber who achieved something that was once thought impossible: climbing Yosemite National Park's El Capitan without ropes or safety equipment. The documentary is a fascinating exploration of risk, preparation, and the human spirit. Highly recommended!

📃 Blog — What Is a Barbell Strategy? Barbell Strategy Applied To Business - FourWeekMBA - This article gave a deep dive into the Barbell Strategy and how can it be applied to business in managing innovation bets, which is pretty interesting.

📃 Blog — 20 Years of Wisdom From Amazon's Jeff Bezos | The Motley Fool - This article summarizes Jeff Bezos' 20 years of letters to shareholders. Of particular note is the 2006 edition, in which he emphasized the importance of optionality. This led to the tech giant's efforts to invest in Amazon Marketplace and AWS, which eventually became hugely successful.

Member discussion