18-Mar-23 High Risk = High Return? Think Again!

Hey there!

Do you think high risk always means high return? Think again! The truth is that high returns should be the compensation for people taking risks. In other words, there’s a lot of opportunity where the risk and return ratio is not proportional.

In today's newsletter, we're going to talk about arbitrage and how it can help you find value in market inefficiencies.

What is Arbitrage?

Arbitrage is a strategy that involves buying low and selling high. It can refer to taking advantage of price differences for the same asset in different markets, like buying a stock for $10 on one exchange and selling it for $11 on another. But it can also involve exploiting cultural or regulatory differences to make a profit. The key is to identify market inefficiencies where an asset's price in one market doesn't reflect its true value. By doing this, you can make a profit and help ensure prices across different markets remain in line with each other.

Real-World Examples

Let's take a look at three real-world examples of arbitrage in action:

PE investment in Hong Kong Real Estate:

I had an interesting conversation with my friend working in Private Equity recently. According to him, due to the COVID-19 pandemic and its effect on the hospitality market, the prices of hotels have decreased in recent years, giving PE firms lower acquisition prices.

At the same time, due to the lack of affordable housing in Hong Kong, many people choose to rent an apartment instead of buying a house. This has created a lucrative market for service apartments, as people are willing to pay a premium for apartments that offer amenities and services typically associated with hotels, such as housekeeping and laundry services.

As a result, some of the smart money in the market have been converting 3-4 star hotels in Hong Kong into service apartments and renting them out at a slightly higher price than the market average. By charging a lower daily rent price compared to hotel rooms, they can secure a long-term tenant that will stay for at least a year (vacancy issue has long been the greatest risk in the hospitality industry). Furthermore, the expectations on service level of a service apartment is much lower compared to a hotel that changes your towel every day and provides a decent breakfast buffet, leading to a lower cost.

Adding up all of these factors make this a great investment with lower risk but surprisingly higher return.

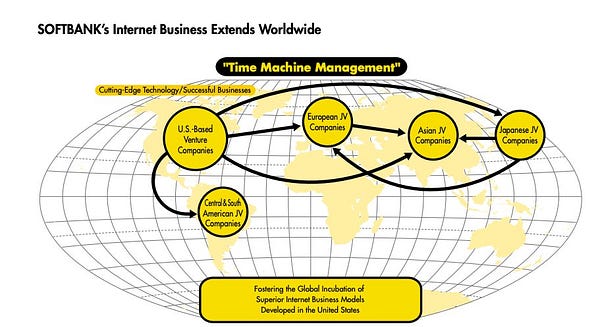

Time Machine Theory by Masayoshi Son

Masayoshi Son, the founder of Softbank, applied the concept of arbitrage to his investing strategy. His “Time Machine theory” stated that the US represents the future, and every other country will eventually go through similar technology transitions as the US. Therefore, investing in countries that are behind the US in terms of technology is like traveling back in time. This approach allowed him to invest in Alibaba early on (as Amazon has proved the huge potential of e-commerce), and the idea has since become influential in Asia's investment circles. Nowadays, many Chinese tech companies are also applying similar principles to replicate their best practices that have proven successful in less developed markets such as ASEAN and Africa.

Cultural Arbitrage in Global Supply Chain:

Another interesting example would be how differences in food preferences between the US and China can be arbitraged in the global supply chain. Americans don't like chicken feet, duck necks, and other foods that are popular in the Chinese market. In 2017, data from the Financial Times showed that Americans consume up to 9 billion chickens per year, leaving the surplus chicken feet to be exported to China. Companies can buy chicken feet at a low price in the US, transform them into the popular "phoenix claws" (鳳爪), and sell them at a higher price in the Chinese market, to make a profit.

P.S. Shoutout to my personal friends, Jonathan, Jimmy, and Wayne, for schooling me on the definition of arbitrage and hooking me up with some of these case studies.

And let me tell you, arbitrage isn't just for finance bros anymore. You can apply the concept of buying low and selling high to your daily life and career. Whether it's finding a deal on a product in one location and reselling it for a profit in another or leveraging your unique skills and experiences to stand out in a competitive job market, there are endless opportunities for arbitrage all around us. By identifying market inefficiencies and taking advantage of them, you can increase your return while minimizing your risk. So don't be afraid to think outside the box and look for ways to profit from the differences and disparities that exist all around us!

That's it for today's newsletter! Thanks for reading and happy arbitraging!

Best,

Sherman

Things that I found interesting this week:

📚 Book — “Skin in the Game”/ “Anti-fragile” by Nassim Taleb → It’s almost impossible not to come across Nassim Taleb’s work when we are talking about risk and return. While both "Skin in the Game" and "Anti-fragile," are excellent reads Taleb explores the concept of risk and how it plays a role in our lives, particularly in the realm of finance and economics. He argues that many traditional risk management strategies are flawed and suggests a different approach to managing risk.

🎙️ Podcast — #252 Elon Musk: SpaceX, Mars, Tesla Autopilot, Self-Driving, Robotics, and AI | Lex Fridman Podcast → In this interview with Lex Fridman, Elon further explains his ways of thinking and how he plans to govern Mars, if possible. I found it particularly interesting how he imagines everything at a 100% ideal state, even assuming the atoms are being arranged in the most efficient way, in order to set the direction for reverse engineering. In consulting, we always highlight the importance of "not reinventing the wheel." While this can be efficient, it can also lead to path dependence and a lack of breakthroughs. I think Elon’s words can be served as a good reminder to all of us.

Member discussion